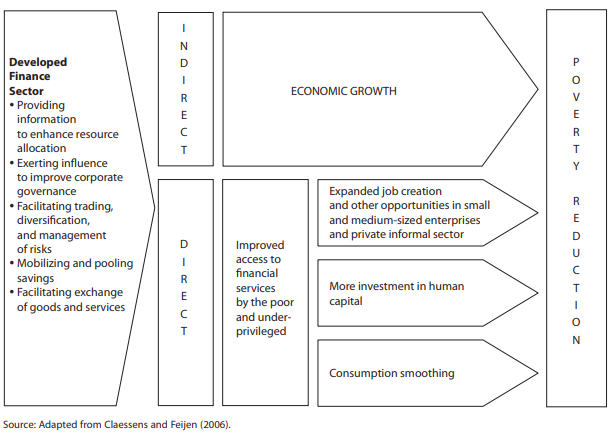

Theoretically, the indirect effect of the financial development on poverty was studied in a dichotomous way.

- A first set of works finds a positive correlation between the financial development and the economic growth (King and Levine, 1993a; Levine, 1997; Khan and Senhadji, 2000; Levine, 2005; Federici and Caprioli, 2009; Kabir et al., 2011; Barajas et al. 2013, etc.).

- A second one however finds an increasing relation between the evolution of the average income and the income of the poor (Ravallion, 1993; Bruno et al., 1998; Dollar and Kraay, 2002; Norton, 2002). Financial development produces faster economic growth, but it has been unclear whether it also shrinks poverty. Researchers have not determined whether financial development benefits the whole population, whether it primarily benefits the rich, or whether it disproportionately helps the poor. The impact differs across regions, income levels, and types of economy (developed vs. developing)

two direct effects of financial development on poverty:

- The capital conduit effect was developed by McKinnon (1973) which consider an economy with a lack of organized financial markets and the absence of a distinction between savers and investors. If the poor finds that holding money is more attractive, the opportunity cost of saving is automatically reduced and therefore the McKinnon capital conduit was amplified and financial development does not contribute to the reducing poverty

- The threshold effect was deduced from the direct relationship between financial development and poverty based on the following hypothesis: "As the financial system develops, it may extend its services to the poor". In order to facilitate the access of the poor to financial services, it is necessary that the financial system reaches a threshold level of efficiency and competitiveness in providing services to poor.

- Another way by which financial development can directly affect poverty has been developed by Rajan and Zingales (2001) and is related to the abilities of bigger and more powerful financial intermediaries to bear the costs of small credits. According to Chigumira and Masiyandima (2003) the marginal cost of lending to the poor and SMEs is higher than that of lending to the rich and large businesses. SMEs are considered as the most obvious hunting ground for poverty reduction in less developed countries because they are employment intensive, and job creation is important in poverty reduction.

Boukhatem, J. (2016). Assessing the direct effect of financial development on poverty reduction in a panel of low- and middle-income countries. Research in International Business and Finance, 37, 214–230.Sumber:

-----------------------------------------------------------------------------------------------

The literature distinguished mainly two arguments

that can justify a direct impact of financial development on poverty, namely the McKinnon ‘conduit’

effect and the Shaw ‘intermediation’ effect.

- The Mckinnon’s ‘conduit’ effect. Financial saving is the fundamental element in the analysis of McKinnon (1973), focuses on the effect of the financial sector on the supply of resources, that is, financial saving,

- The Shaw’s ‘intermediation’ effect. Shaw (1973) looks at the effect of the financial sector on the distribution of resources, that is, credit activities.

Sumber:

Kiendrebeogo, Y., & Minea, A. (2016). Financial development and poverty: evidence from the CFA Franc Zone. Applied Economics, 48(56), 5421–5436.

Tidak ada komentar:

Posting Komentar